A Perfect Storm: How the Surety Cycles Impact Contractors

The surety market is a market of cycles. Similar to the insurance market, the surety market has its ups and downs or its hard markets and soft markets. However, the insurance and surety market do not necessarily coincide. As a contractor, it is important to understand these cycles and specifically how surety cycles impact contractors.

The surety market is a market of cycles. Similar to the insurance market, the surety market has its ups and downs or its hard markets and soft markets. However, the insurance and surety market do not necessarily coincide. As a contractor, it is important to understand these cycles and specifically how surety cycles impact contractors.

Understanding How Different Surety Cycles Impact Contractors

How Surety Market Cycles Work

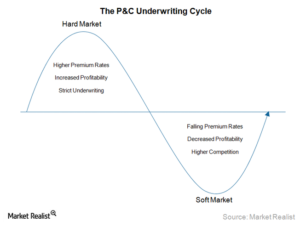

The surety market cycles consist of hard and soft markets and the time period between transitioning from one to the other – this is no different than the insurance market.

- As the graph shows, a hard market is characterized by a period of strict underwriting, increased premiums, contracted capacity and increased surety company profitability.

- Conversely, the soft market is defined by loosened underwriting, decreased premiums, excess capacity and increased surety company competition.

The transition from a hard to soft market is not an overnight sensation and as a result, there are periods of time between cycles where the market indicators may not fully specify a hard or soft market, but fall somewhere in between. Each cycle is entirely unique with no set time frame or indication to move from one to the other. The only certainty is that a hard market will eventually lead to a soft market and vice versa.

Recent Surety Cycles Impact on Contractors

An adjustment in cycles usually begins by an outside event forcing the market to correct. The oil crisis of the 1980's and the tech bubble in the 1990's both instigated hard markets. More recently, the 2001 Enron Scandal and 2006 real estate crash, resulting in a recession, both generated hard surety markets. The 2006 hard market was a unique phenomenon for several reasons. The two main reasons are that the surety underwriting results remained profitable and that it was longer than a typical hard market.

In fact, for the past 11 years (and counting) surety results have been extraordinary. Typical hard markets generate an industry-wide net underwriting loss or break even. However, the last hard market (caused by real estate crash and recession), the surety industry maintained profitability, and not just barely, but at unprecedented levels of underwriting profit.

The Current Soft Market

Another major external event or events that influence the surety market is spending, and for the surety market most notably, construction spending. While we are not at the levels of construction spending we saw in 2006, at that time over $900 billion, the market has recovered nicely from the low point in 2010 of only $501 billion to just under $700 billion in 2015 at $698 billion.

Fortunately for most of the readers, this spending is occurring within the Southeast, as a report from the Associated Builders and Contractors reported that the Southeast had an average construction backlog of over 11 months. This outpaces the next highest regional backlog in the Northeast of just about 8.5 months. The benefits to the Southeast are obvious, high employment in construction, increasing margins, therefore increasing bottom lines, and the point of this article, a softening surety market.

As noted the surety industry has experienced unprecedented profitability. This has made the business of surety very attractive and as a result, the surety industry has seen an influx of new entrants into the business of writing surety bonds. In fact, since 2007 there have been 25 new companies enter the surety market. At an average of tens to hundreds of millions in capacity, with the new entrants, billions of newly available capacity dollars are available to be utilized to write bonds.

High profitability, excess capacity and now a growing market have created a perfect storm for a soft surety market. Surety companies are clamoring to write your next bond.

What does this mean for a contractor?

It means that there has never been a better time to obtain surety credit.

The competition in the marketplace currently has driven sureties to become ever increasingly creative and lenient. If you have never had surety credit before or have been declined by a surety before now is the time to consider bonded work or even just pre-qualifying for surety credit, as the time to obtain surety credit has never been easier. With the right surety representation, you will be able to position your company to prepare for harder times.

For the most qualified surety credits, items such as rate, capacity, and indemnity are on the table. If you are not now discussing these issue with your surety agent, I would encourage you to ensure you are represented by an industry professional. Someone who has significant experience in surety and can facilitate the navigation of the current soft market. Because as experience tells us, the only certainty is that our next market will be a hard one and making the right moves now in the soft market can give you and your firm the competitive advantage needed in future cycles.

Learn More

If you would like to speak to a surety expert, please contact Daniel Oaks of Nieslon, Hoover & Associates, Inc. He has over 12 years of surety experience with more than 8 years as an underwriter and manager for top tier surety companies. For several years now he has used that expertise to represent contractors and maximize their surety programs. He can be reached directly at (813) 786-0831 or (850) 733-8868 or email him at [email protected]. You can also learn more about Nielson Hoover & Associates, one of the largest surety agencies in the nation, at www.nielsonbonds.com. Or, contact us!